Consistently recording financial transactions is essential for companies and small businesses, helping them grow. However, understanding and organizing financials can be a complex problem requiring a professional solution. This is where the services of a virtual bookkeeper are sought after.

But what is virtual bookkeeping?

In this article, we’ll cover what a virtual bookkeeper is. We’ll also examine what a virtual bookkeeper does and how to become one.

What Is a Virtual Bookkeeper?

A virtual bookkeeper is someone who offers online bookkeeping services. . The term refers to hired freelancers and full-time internal employees working remotely. Virtual bookkeepers rely on accounting technology to ensure a business’s books are up-to-date.

These professionals are a good alternative for small business owners who don’t have the resources to hire an in-house bookkeeper.

What Does a Virtual Bookkeeper Do?

A virtual bookkeeper does daily financial tasks like preparing payrolls, grant accounting, and reconciling bank statements and credit cards. Virtual bookkeepers rely on SaaS (Software as a Service) accounting software on cloud remote servers to retrieve financial documents.

If you’re a business owner looking to hire a virtual bookkeeper, it’s worth knowing that there are VA scams online. So, knowing how to spot virtual assistant scams is crucial.

Here’s what a virtual bookkeeper does daily:

- Prepare Balance Sheets.

A balance sheet helps a company assess its debt, and investors know the potential returns. Virtual bookkeepers prepare monthly, quarterly, and yearly balance sheets. - Monitor Accounts Payable.

This is what a business owes suppliers for goods and services. With payment approval, bookkeepers can also settle these bills. - Note Accounts Receivable.

This refers to what customers owe you for goods and services offered. Bookkeepers send out invoices and payment notices and bill customers. - Reconcile Bank Statements and Credit Cards.

It is the process of comparing transactions to ensure accurate bookkeeping. - Grant Accounting.

Tracking individual grants to denote compliance requirements, revenue, and expenses. - Preparing Payrolls.

It includes calculating employees’ salaries, setting PAYE on time, and deducting taxes.

Important! These are just some of the tasks a virtual bookkeeper does. However, what a remote bookkeeper will do may vary depending on your needs and employee agreement.

How to Become a VA Bookkeeper?

You can become a VA bookkeeper by acquiring training, learning to use accounting software, applying for positions, and getting certifications. Alternatively, you may launch your bookkeeping business and market yourself using different methods, such as word of mouth or a website.

These are the steps for becoming a virtual bookkeeper.

Step 1: Acquire Training

This can be done through a college degree, online courses, or seminars. You don’t have to be a Certified Public Accountant (CPA) to do bookkeeping.

Training is vital to learn the essential skills needed for bookkeeping. Ensure the courses you pick provide valuable information necessary to become a competent bookkeeper.

Step 2: Learn How to Use Accounting Software

Accounting software like Quickbooks streamlines the bookkeeping process. Most clients rely on this software to share information via the cloud.

Therefore, to become a remote bookkeeper, you must know at least the basics. Since most of these software are subscription-based, you can pick just one to learn the ins and outs.

Step 3: Apply for Positions

After learning the basics, you should look for remote bookkeeping positions on online platforms like Indeed, Upwork, and ZipRecruiter. You can either become a full-time local bookkeeper, work on-site, or choose freelancing.

Ensure you have a well-written resume that highlights your skills. To gain experience, consider volunteering or an entry-level job.

Step 4: Get Certified

Getting a certification is important. It helps secure high-end clients since most consider certified bookkeepers skilled and experienced.

However, this will come later after working for at least two years. Depending on your country, you must pass an examination and commit to a particular code of ethics.

Find out more details about getting clients as a virtual assistant here.

Can You Be a Bookkeeper If You Are Bad at Math?

Yes, you can be a bookkeeper if you are bad at math. Modern bookkeeping doesn’t need much math expertise since it relies on software and specialized programs. Nevertheless, you need at least a basic mathematics level, something a high school graduate should possess.

To become a bookkeeper, you should know how to operate a computer and generate reports. Additionally, have the capability to analyze reports and draw plausible conclusions.

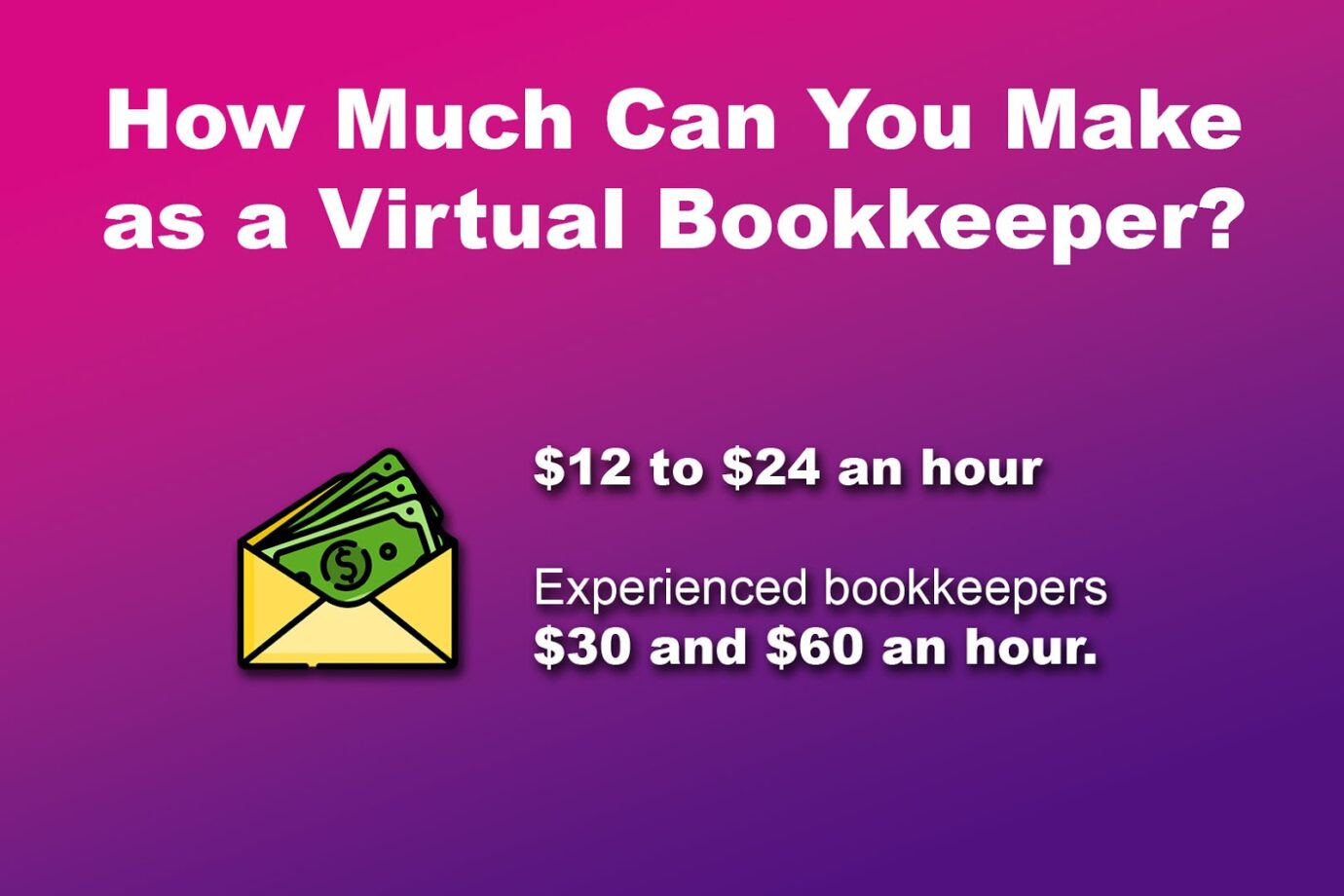

How Much Can You Make as a Virtual Bookkeeper?

A virtual bookkeeper can make around $12 to $24 an hour, mostly in the first year. The average pay varies by over $10, showing that experience, skills, and expertise significantly affect a bookkeeper’s compensation. Experienced bookkeepers can make between $30 and $60 an hour.

The U.S. Bureau of Labor Statistics reported that bookkeepers made $45,860 annually as of 2022. This equates to $22.05 per hour.

To increase your earning potential, you must be certified and undergo additional training, such as becoming a CPA. Consider offering monthly packages instead of charging by the hour if you have a personal website.

Learn how to make money as an online bookkeeper from Linkedin.

The Benefits of Virtual Bookkeepers

Here are the benefits of virtual bookkeepers:

- Cost-Effective.

Hiring a virtual bookkeeper can help reduce costs associated with an in-house bookkeeper. This includes providing equipment, such as laptops, and renting office space. - Flexibility.

Virtual bookkeepers can work from anywhere worldwide as long as they have an internet connection. As an employer, you can find talented bookkeepers from other countries at a reasonable cost. - Time Saving.

Managing your finances can be time-consuming. A bookkeeper can handle automated tasks, like payroll, freeing up your time to focus on other important tasks. - Improve Accuracy.

Hiring professionals to manage their books can help companies and businesses avoid financial errors. Additionally, all financial information will be kept up-to-date. - Access to Expert Advice.

A skilled bookkeeper can also provide valuable accounting advice. They can offer valuable insights and advice on financial matters. - Streamline Financial Processes.

A bookkeeper can help streamline the process of managing payroll, billing clients, and debt payments. - Compliance with Regulations.

A bookkeeper is knowledgeable about tax laws and regulations. They can help businesses avoid hefty fines by ensuring all necessary documents are completed by the deadlines.

Discover more benefits of a virtual bookkeeper from Linkedin.

Virtual Bookkeepers Services Are Essential!

A bookkeeper is essential for both businesses and companies. They help manage finances, bank reconciliation, billing, and preparing bankroll.

Having a bookkeeper can help organizations manage their financial requirements and obligations. Your earning potential and limitations as a bookkeeper will depend on your skills and expertise.